Financial Aid Literacy

Resources and tools to help you make smarter decisions. These tools are resources are here to help you empower yourself and become financially fit. We at Saint Augustine’s University are committed to educating and maintaining outstanding financial help. Students with questions should contact the Office of Financial Aid & Scholarships.

- Types of Financial Aid | Federal Student Aid Grants, loans, scholarships

- Annual Credit Check- Obtain & read my credit score

- Repayment Estimation- How to repay

- Loan Borrowers- types of loans, MPN, responsible for borrowing

- Manage Loans | Federal Student Aid– Review loan balance

- Consumer Resources | Consumer Financial Protection Bureau (consumerfinance.gov) Consumer Education information

- Money Management – Manage money wisely

- Budgeting Basics/Budget Planner– How to budget

- Savings- Planning for your future

- Identity Theft– How to prevent it

- Glossary of Terms- Financial terms

Financial Responsibility Guidelines

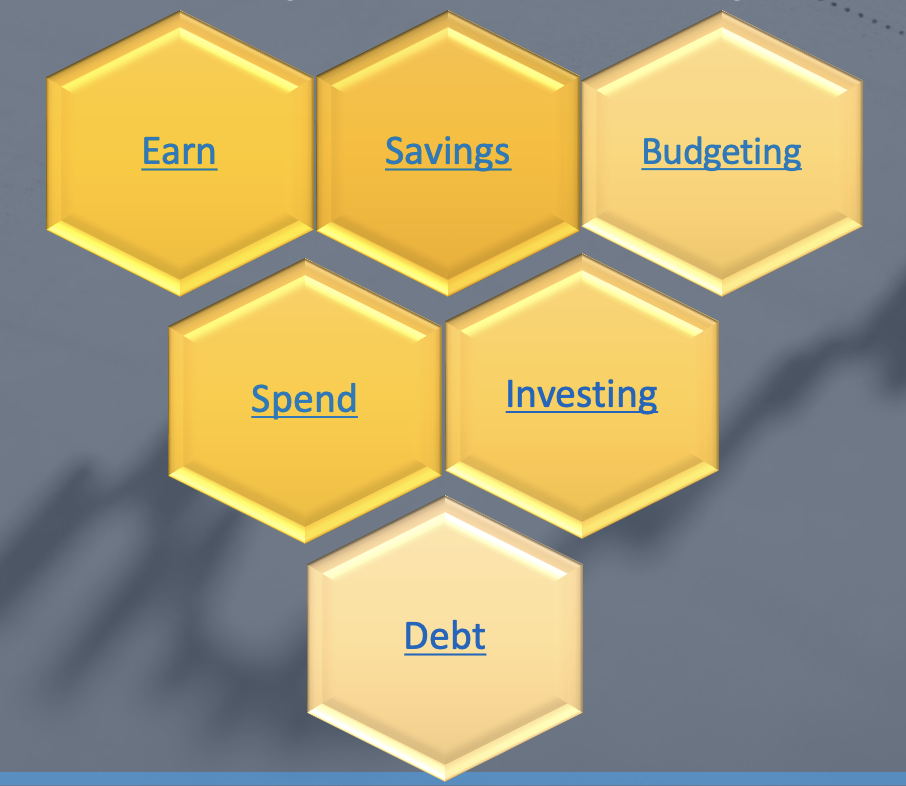

6 Crucial Areas Financial Literacy

Students learn the fundamentals of money management, including savings, debt, and investing, basic concepts of how money matters, and understanding how to build wealth that works for you.

Money Management Tips

- Financial aid is intended to assist with a very modest student lifestyle, including only the basics: tuition and fees, room and board, books, and a small amount for personal expenses such as clothing, laundry, haircuts, long-distance charges, an occasional movie or dinner out, and so on. Financial aid is NOT intended to pay for your car, iPhone, cigarettes, or spring break trip.

- For each expenditure, ask yourself: Do I really need this? If you are taking out student loans to cover “extras”, do you really want to be paying interest years after graduation for items you could do without for now? Your time at SAU is a terrific chance to meet and mingle with people of many interests and cultures. Think of this as a free source of entertainment and enrichment.

- Protect your future: Don’t borrow more than you need. If you don’t need all the loans you’ve been offered, you may decline or reduce them in Student Portal – Saint Augustine’s University (st-aug.edu).

- Consider your living arrangement. Is that luxury apartment really a good deal? Do the math. If you live on campus, your “rent” includes all the food you need (even prepared for you with no dishes to do!), your bed linen, high-speed internet, and you can walk to your classes. In an apartment, in addition to your rent, you will have to find your roommate(s), purchase and cook your own food, get yourself to class, produce a rent deposit, pay for utilities, and possibly buy furniture. Add up all the costs associated with apartment living, compare it to campus living, and see which is the better deal.

- Be careful with credit cards! If you don’t have the cash for a purchase, you probably can’t afford it. However, if you have a reasonable budget for personal expenditures and can pay off your credit card in full each month, you will build good credit for your future.

- Don’t use an ATM card for an individual purchase if a fee is involved. Do you really want to pay $2.25 for a $1.50 taco? These little fees add up fast.

- Give yourself an allowance. Know what you can afford to spend for goodies each month and make a monthly withdrawal. Divide that into weekly envelopes to help you stay within your budget.

Rights and Responsibility

Rights

Know when financial aid has been disbursed

Has the right to know the deadlines

Has the right to know correct procedures when applying, cost of attendance, types of aid available

Has the right to know the interest rate of the loan in which they borrowed

Know withdrawal policy and procedures and how it affects their aid

Has the right to know SAP policy

Has the right to know how to reduce, reject and accept aid

Has the right to privacy

Has the right to reapply for financial aid each year and priority

Responsibility

The student is responsible for understanding Financial Literacy

Understand the policy and procedures of the university, which include the Refund Policy and Return to Title IV

To complete things in a timely manner

Current information is accurate and keep a record

Regularly check their accounts and emails for financial information

The student is responsible for meeting SAP policy

To make sure they have done entrance and exit counseling

To understand the review of the conditions of their financial aid award

To inform the Financial Aid Office if they accepted any outside scholarship or have additional aid

Carefully review and understand all information and keep copies of all forms they signed

Financial Aid Checklist

Our mission is to sustain a learning community in which students can prepare academically, socially, and spiritually for leadership in a complex, diverse, and rapidly changing world. Please use the below checklist to help assist with your Financial Process.

- Complete the Free Application for Federal Student Aid (FAFSA)

- Review your FAFSA Results

- Review your Student Aid Report (SAR) from nonreply@fafsa.gov

- Review results in Falcon Landing

- Submit any documents or requested information(if any)

- Review your Financial Aid offers

- Grants and Scholarships are automatically accepted

- Accept or Decline offered student loans via Falcon Landing

- If accepted aid is greater than charges, NO FURTHER ACTION IS REQUIRED

- If accepted aid is less than charges, ACTION REQUIRED

- Apply for Additional Scholarships

- Apply for WorkStudy

- Consider a Payment Plan

- Consider a Parent Plus Loan

- Consider a Private or Alternative Loan

Helpful Tips:

Credit Basics and Best Practices

The Difference Between the Financial Office and Business Office

Financial Aid assists students with financial aid eligibility and the FAFSA, scholarships, loans, grants, and work-study.

The Business Office assists with billing and payment due dates, identifying holds/removal of holds, receipt of outside scholarship and direct pay third-party checks, special billing (third-party contracts and payment plans), and refunds.